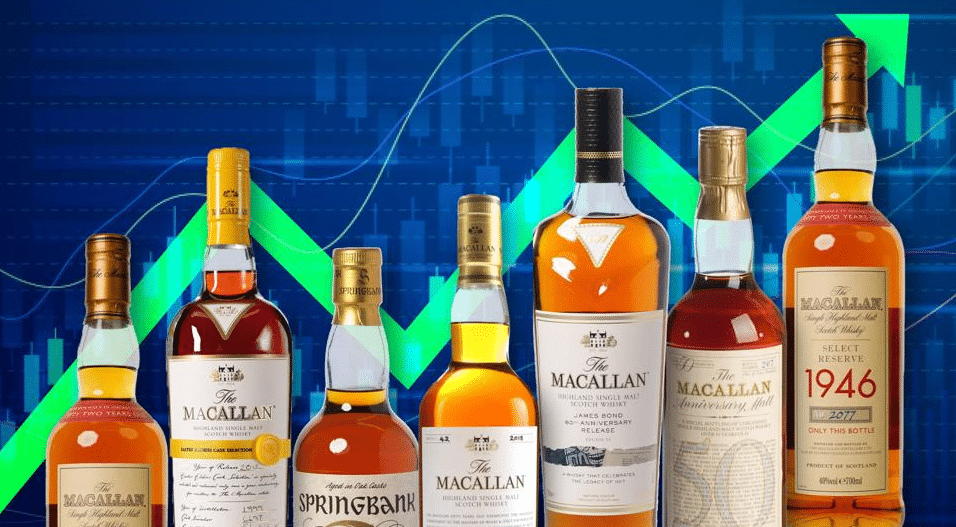

As investors continue to navigate uncertain market conditions, interest is growing in alternative assets that offer diversification, tangible value, and long-term potential. One area attracting increasing attention is whiskey investment, particularly in rare casks and limited-edition bottles.

Once viewed primarily as a collector’s pursuit, whiskey is now being considered by a broader range of investors seeking assets that behave differently from equities and bonds.

Why Whiskey is gaining investor interest

Whiskey has several characteristics that appeal to long-term investors. Unlike many financial assets, supply is inherently limited. A cask can only be produced once, and as it matures, it becomes scarcer over time. This natural constraint, combined with growing global demand, has supported strong price appreciation in certain segments of the market.

Premium Scotch whiskey, in particular, has benefited from rising interest across Asia, North America, and the Middle East. As wealth levels increase globally, demand for aged and branded spirits has followed.

Performance and diversification benefits

While returns vary widely depending on quality, provenance, and timing, high-end whiskey has delivered attractive long-term performance in select cases. Importantly for investors, whiskey prices tend to have a low correlation with traditional financial markets. This makes it a useful diversification tool within a broader investment strategy.

During periods of equity market volatility, tangible assets such as whiskey can provide portfolio balance, especially when combined with other alternatives like property or private investments.

Cask investment versus bottled Whiskey

Investors typically access the market in two main ways.

Cask investments offer exposure earlier in the maturation process. Value can increase as the whiskey ages, with returns influenced by storage, insurance, and bottling decisions. This approach often suits investors with a longer time horizon.

Bottled whiskey investments focus on rare or limited releases. These tend to be more liquid but are often driven by brand strength, auction demand, and collector sentiment. Both routes require careful selection and professional oversight.

Key risks investors should consider

Like all alternative assets, whiskey investing is not without risk. Liquidity can be limited, pricing is not always transparent, and returns are not guaranteed. Storage conditions, insurance, authenticity, and exit strategy all play an important role in outcomes.

For this reason, whiskey investments are generally best suited to experienced investors who understand the risks and take a long-term view.

Why whiskey fits into a broader investment conversation

The growing interest in whiskey reflects a wider trend. Investors are increasingly open to alternative assets that offer differentiation, scarcity, and tangible value. As traditional markets become more complex, assets with unique supply and demand dynamics are attracting renewed focus.

When approached professionally and as part of a diversified portfolio, whiskey can play a complementary role alongside more conventional investments.

Final thoughts

Whiskey investing is not about short-term speculation. It is about patience, quality selection, and understanding the market. For investors willing to take a measured and informed approach, it represents an intriguing addition to the alternative investment landscape.

As with any investment, careful due diligence and expert guidance remain essential.